Infographics

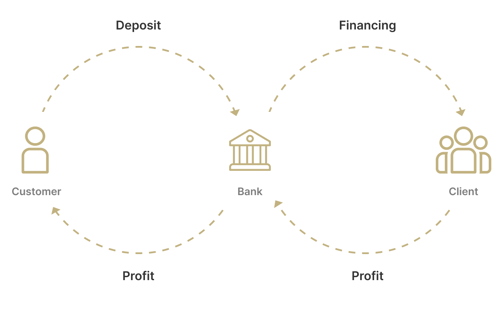

Deposit Handling

Customers place their deposits with the bank, and the bank then utilises these funds to provide Syariah-compliant financing to other clients through contracts such as Murabahah or Ijarah.

Earning Mechanism

Clients repay the financing amount together with an agreed profit margin (rather than interest). The bank’s income is derived from these profit-based transactions, ensuring compliance with Syariah principles.

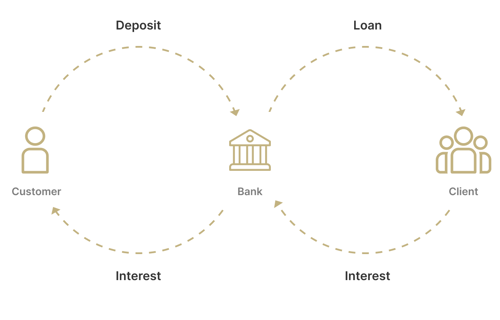

Deposit Handling

Customers deposit money into the bank, which then uses these funds to provide interest-bearing loans to borrowers.

Earning Mechanism

Borrowers repay the loan together with interest. The bank earns profit through the interest rate spread - the difference between the interest charged on loans and the interest paid to depositors, while depositors receive interest income on their savings.

How It Works

Participants contribute money to a takaful fund managed by a takaful operator, with contributions made on the basis of donation (tabarru'). In the event of misfortune, such as an accident or death, affected participants receive compensation from the shared fund.

Underlying Principle

Takaful is based on risk-sharing and mutual cooperation, operating under Syariah principles without involving interest (riba) or uncertainty (gharar).

How It Works

The company provides coverage and pays out claims in the event of insured risks (e.g. accidents, death).

Underlying Principle

Conventional insurance operates on the principle of risk transfer, where the insurer assumes the policyholder’s risk in exchange for premium payments. The insurer generates profit through risk-based pricing and interest-bearing investments.

How It Works

An Islamic capital market is one in which all transactions and operations comply with Syariah principles. Securities and financial instruments must be free from riba (interest), gharar (excessive uncertainty), and haram (prohibited) activities, ensuring ethical and Syariah-compliant investment practices.

Key Features

The Islamic capital market contains instruments such as Sukuk (Islamic bonds), syariah-compliant stocks, and Islamic mutual funds, with an emphasis on ethical investing and asset-backed securities.

How It Works

A conventional capital market is a marketplace where capital providers and seekers meet to buy and sell securities. It facilitates the mobilisation of funds from investors with surplus capital to businesses or governments that require financing.

Key Features

Includes stocks, bonds, mutual funds, and derivatives.